Cars come in different shapes and sizes and insurance group ratings are one factor typically used by insurers to calculate your premium. Car insurance groups take into consideration the vehicle’s cost to repair, value when new and security to categorise it.

While it’s not compulsory for insurers to follow car insurance groups, they present a standardised way to categorise vehicles in accordance to price and risk. Not all insurers will choose to follow them, but they can provide a general indication towards insurance cost for prospective customers.

Insurance groupings are decided by the Group Rating Panel (members of the Association of British Insurers and the Lloyds Market Association), which is supported by Thatcham Research, who meet every month to classify new vehicles. There are 50 car insurance groups with 1 typically being the cheapest and 50 being the most expensive to insure. Cars in group 1 carry the lowest risk to an insurer. They’re often well-equipped with safety features, moderately priced, cheap to repair and have a lower performance.

The Association of British Insurers (ABI) hold a group rating panel every month where they assign a rating to each new model of car.

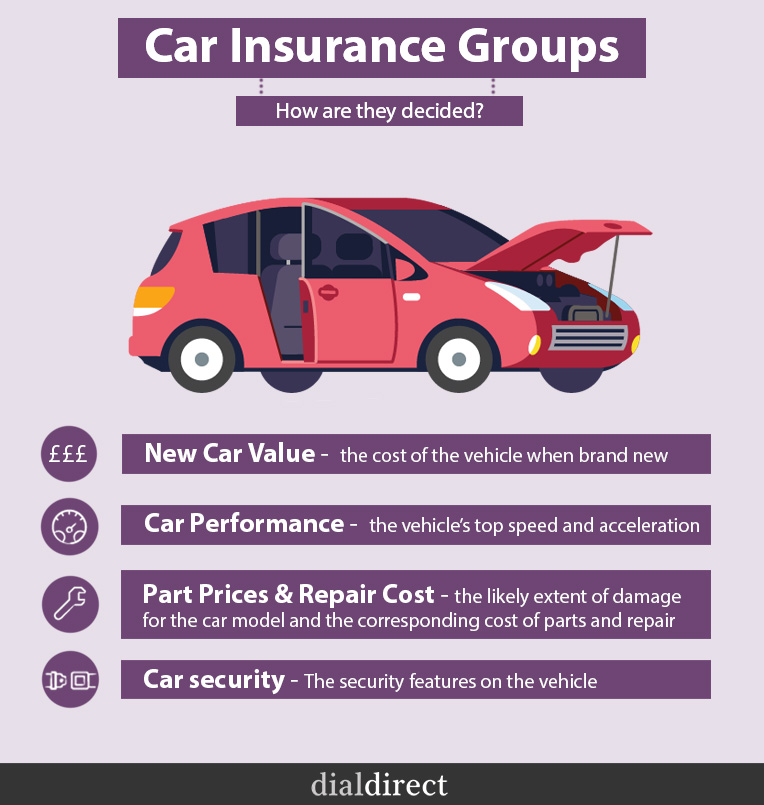

The factors the ABI take in account to do so are:

Car insurance groups also have standard levels of security features for each group, the letter will appear alongside your group number rating and the higher the group means the higher level of security required.

While insurance groups aren’t the only factor considered for insurance, they can give you a guideline as to how much your insurance will cost. For more information and advice, read our helpful guide on car insurance.